Table of Content

- Rates & fees

- Documentation

- Eligibility Criteria for Kotak Mahindra Bank NRI Home Loan

- Can I get the benefit of reduced interest rates in the intervening period or during the balance tenure of my loan?

- Kotak Mahindra Home Loan Interest Rates

- Get matched with the best mortgages for your situation

- Home Loan Bank Information

Hypofriend’s Optimization Engine will recommend the optimal fixed interest period for your situation. Use the calculator to understand your mortgage repayment options. Loan Tenure is a period for which you have availed the loan. You need to repay full loan and interest thereon during this period. Kotak Mahindra Bank offers NRI Home Loan at the interest rate of 6.55 which is very attractive. One can even negotiate on interest rate provided he/ she carries good Credit Score, good relations with the lender, clean repayment history and regular income.

\n \n \n The bank looks out for the income status of the applicant. Before an application of home loan, Yes bank has every right to seek for the individual’s financial picture and the creditworthiness of the same. \n \n \n As a signature proof, Pan card, driver’s license, passport copy or banker’s attested bank account statements are required. Any of the documents mentioned above are to be submitted positively.

Rates & fees

We were able to secure a loan for even more than we expected with a fantastic rate and this was done quickly and with great customer service. From the first touchpoint, they guided us through step by step and answered our overwhelming amounts of questions. Fixed interest rateThe longer you fix the interest rate, the more security you have in planning your mortgage loan. However, you also have to accept higher costs, because the longer the fixed interest rate, the higher the interest rate that the bank will call. With a short fixed interest rate period, on the other hand, you benefit from a lower interest rate. But you take a risk as a higher loan balance remains at the end of the fixed interest rate and you may have to take out significantly higher refinancing for it.

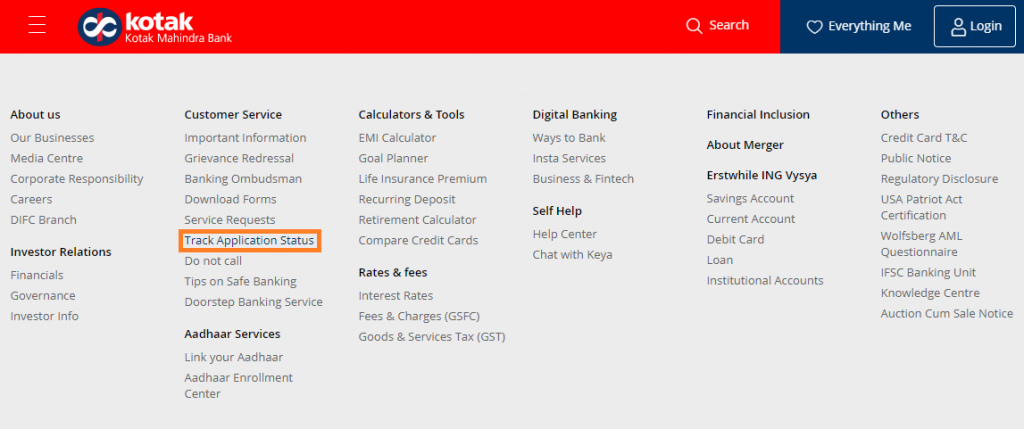

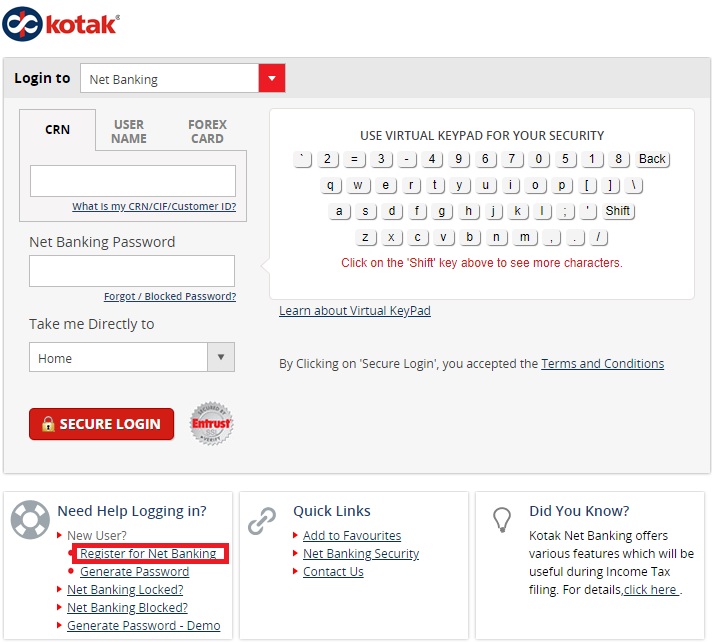

Applying for a home loan in Kotak Mahindra is as simple as learning the alphabets. An active international account or salary of half a year. Personal guarantee by a third party is mandated if loan is sought individually.

Documentation

Kotak Mahindra does not have strictness about interest rates. With the moderately feasible interest rates, repayment in monthly instalments become easier within the tenure of the loan. Women applicants can pay flat Rs 5000 as a processing fee when applied offline.

For each and every loan in floating rate or the Kotak Flexi loan, the financial provider shall not accept prepayment before 6 months starting from the first EMI’s date. This implies that at least 6 EMIs should have been paid by the borrower before applying for a foreclosure. After completing this, the applicant shall foreclose the loan by giving a 4% prepayment charge on the principal amount outstanding plus 4% of the amount pre – paid in the past 12 months. But still, a gap of minimum 6 months shall be there between the 1st EMI date and the part payment. The bank shall allow part – payment free of charges in the case; the borrower wishes to repay their loan equivalent of 25 % of the outstanding amount.

Eligibility Criteria for Kotak Mahindra Bank NRI Home Loan

Such interest is called the Pre-EMI which will continue until the final disbursement of the loan. Kotak Mahindra Bank offers NRI Home Loan for maximum tenure of 15 Years. Salaried applicants are likely to get a slightly lower rate compared to the self-employed because of less risk involved. After you avail loan, you have to repay the loan along with interest in the form of Equated Monthly Instalment every month till the tenure of the loan.

We discuss the outcomes and logic of the recommendations with you. You are different from the average customer, sometimes a little and sometimes a lot. To optimize the recommendation engine, we review daily the mortgage products and conditions of over 750 lenders. This is how we can understand exactly what offers are available and what conditions they have. Our engine combines modern finance theory with practical insights from our team of mortgage brokers. \n \n \n As an age proof provide class 10th certificate or/and birth certificate.

You can get up to 80% of the cost of property and in case of a loan against existing property or commercial property, you can borrow up to 60% of the cost of the property. You may have several questions about a Kotak NRI Home Loan. We at SBNRI, are here to help you out with everything related to home loans and other financial and legal services required by NRIs. You can get in touch with our expert directly on WhatsApp using the button below to resolve your doubts and queries. Also visit our blog and YouTube Channel for more details. If you are an individual - your spouse, your parents, or even your major children can be your co-applicants.

You can borrow up to 80% of the cost of the property in case of Home Loans. However in case of Commercial Property Loans or Loans against an existing property you can borrow up to 60% of the cost of the property. Whether you’re a first-time home buyer or looking to upgrade, buying a home can be exciting but stressful. At Kotak Mahindra Bank, we understand your every need and we help you have a pleasurable home-buying experience with highly customised facilities and services. So find a home that’s right for you and let us do the rest.

Prepayment of loan is an exclusive service provided by Kotak Mahindra bank. To elucidate, the customer is free to pay back the loan amount well ahead of the end of original loan tenure. If the applicant has applied for the Kotak Flexi loan scheme or the floating index rate, the bank shall allow foreclosure without any pre – payment charges.

Bank provides a loan repayment tenure of at most 15 years. When RBI increases rates, the bank also holds chances to increase its MCLR rate and thus, the applicable interest rate for all existing and new home loans might increase as well. When RBI reduces interest rates, and consequently, the bank cuts down the MCLR rate, the benefit of lower rates will get passed on to both old borrowers and new house loan accounts. Through its NRI home loan, Kotak Mahindra Bank offers insurance coverage for your property with an attractive premium.

The loan repayment period is up to 15 years, which might vary as per your profile. Kotak offers in – principle approval of your home loan by utilising your income tax credentials without any use of pen and paper. Floating rate on Kotak Bank housing loan is concatenated to its 6 month MCLR rate, which is currently running at 8.70%. When Bank offers a home loan at an interest rate of 8.90%, it applies a premium of 0.2% to its MCLR rate to come to this home loan rate.

However, German banks have different guidelines when it comes to rating the creditworthiness of applicants for a mortgage. For us to find the best mortgage for you, we need more information about you, your financial situation, and your future plans. With this information, our financing experts can explain your possible options in detail and provide a free personalized mortgage recommendation. Different banks offer NRI home loan at different interest rate to the borrowers.

The results of the mortgage calculator give you a first impression of your mortgage possibilities and help you to get orientated. It is a sample calculation that shows an overview of your expected costs. However, our calculator does not replace a personal consultation. A fixation period which is too short could cause you financial hardship if interest rates go up significantly in the future. However, too long a fixation period could result in high costs, inflexibility, or exorbitant cancellation fees if you move on early.

“Simply put, my wife and I would not have our dream home without the help of LoanLink and Başar. Although our personal/financial situation was less than ideal, Başar was able to secure us an extremely favourable loan. Combining this lender know-how with given information and projected information , we evaluate a range of scenarios and outcomes to see how you will fare under different conditions.

No comments:

Post a Comment